Case Study: From Chaos to Control

How a Canadian FinTech Achieved SOC 2 Readiness with vCISO Support

One question stalled multiple enterprise deals: “Can you share your SOC 2 report?”

This case study shows how vCISO leadership built structure fast and turned SOC 2 readiness into a sales enabler.

Read time: 6–8 minutes

Keywords: SOC 2 readiness, vCISO Canada, FinTech compliance, Trust Services Criteria, security questionnaires, audit prep

Note:

Company name and identifying details are generalized to protect confidentiality. The workflow reflects real-world vCISO-led SOC 2 readiness engagements.

The moment the pipeline slowed

The sales call was going well until one question changed everything:

“Can you share your SOC 2 report?”

For this fast-growing Canadian FinTech, that question stalled multiple enterprise conversations especially with banks.

They had a strong product and real momentum.

What they didn’t have was provable security maturity.

The company profile (at a glance)

The challenge: growth outpaced governance

Like many FinTech startups, security had grown organically.

Tools existed but structure didn’t.

As demand increased, so did scrutiny.

Banks and large partners began asking for:

- SOC 2 Type I readiness

- Documented security policies

- Evidence of risk management

- Clear ownership of controls

Internally, the FinTech faced:

- No full-time CISO

- Scattered documentation

- Unclear control ownership

- Anxiety around audits

Impact: Compliance became a blocker in revenue conversations.

Why hiring a full-time CISO wasn’t the answer (yet)

Leadership explored hiring a CISO.

The reality didn’t match the timeline.

- Hiring would take time

- The cost was significant

- The need for results was immediate

They didn’t need headcount.

They needed direction, speed, and credibility.

That’s when they engaged Canadian Cyber’s vCISO services.

The vCISO approach: turning noise into a plan

Step 1: SOC 2 readiness assessment

The vCISO started with a focused assessment against SOC 2 Trust Services Criteria, prioritizing:

- Security

- Availability

- Confidentiality

This clarified what existed, what was missing, and what mattered most without overwhelm.

Step 2: establishing control ownership

The biggest gap wasn’t technical.

It was organizational.

The vCISO created control clarity by:

- Assigning clear control owners

- Defining responsibilities

- Aligning controls with daily operations

What changed:

People stopped guessing.

Everyone knew their role.

Step 3: building structure with an ISMS platform

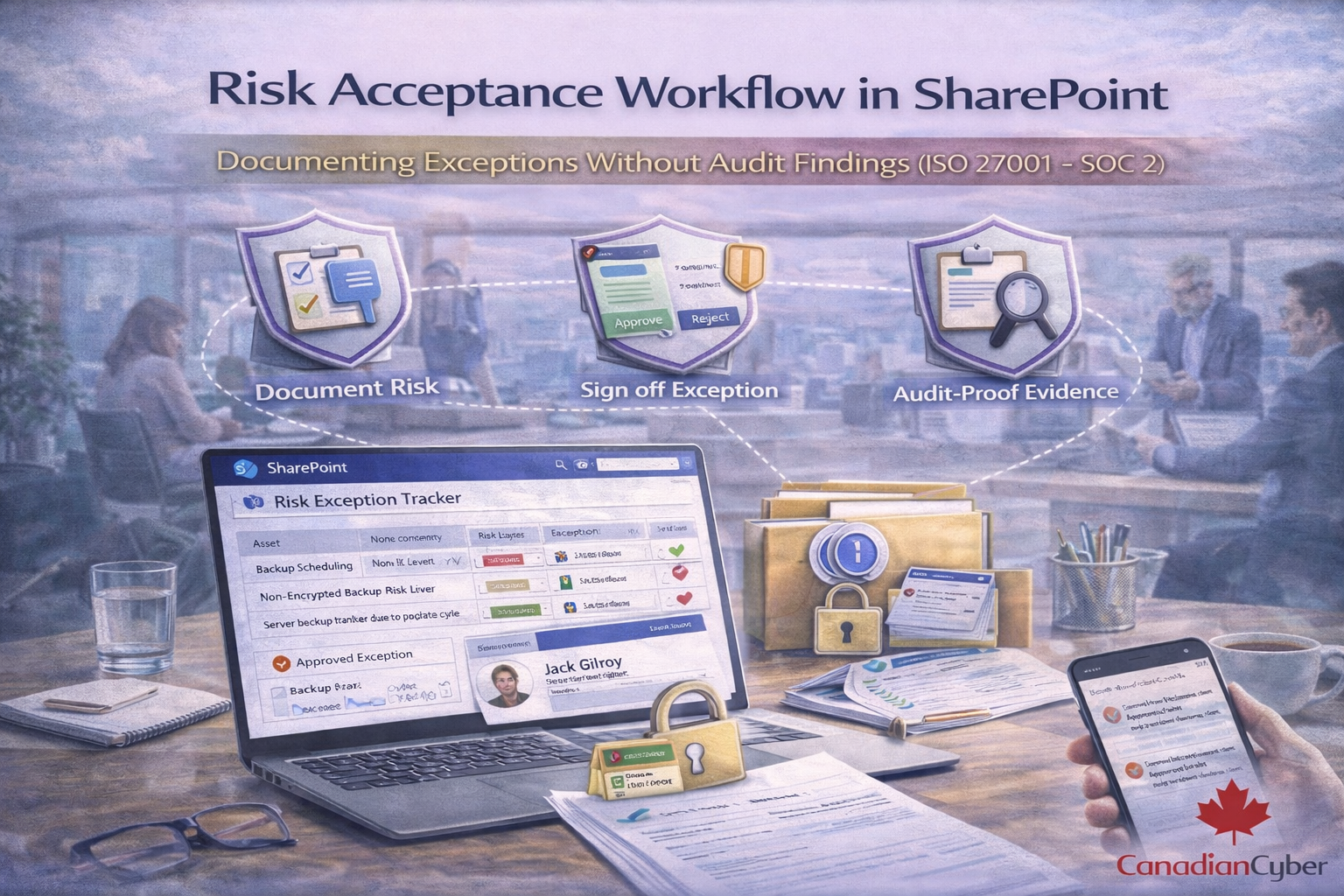

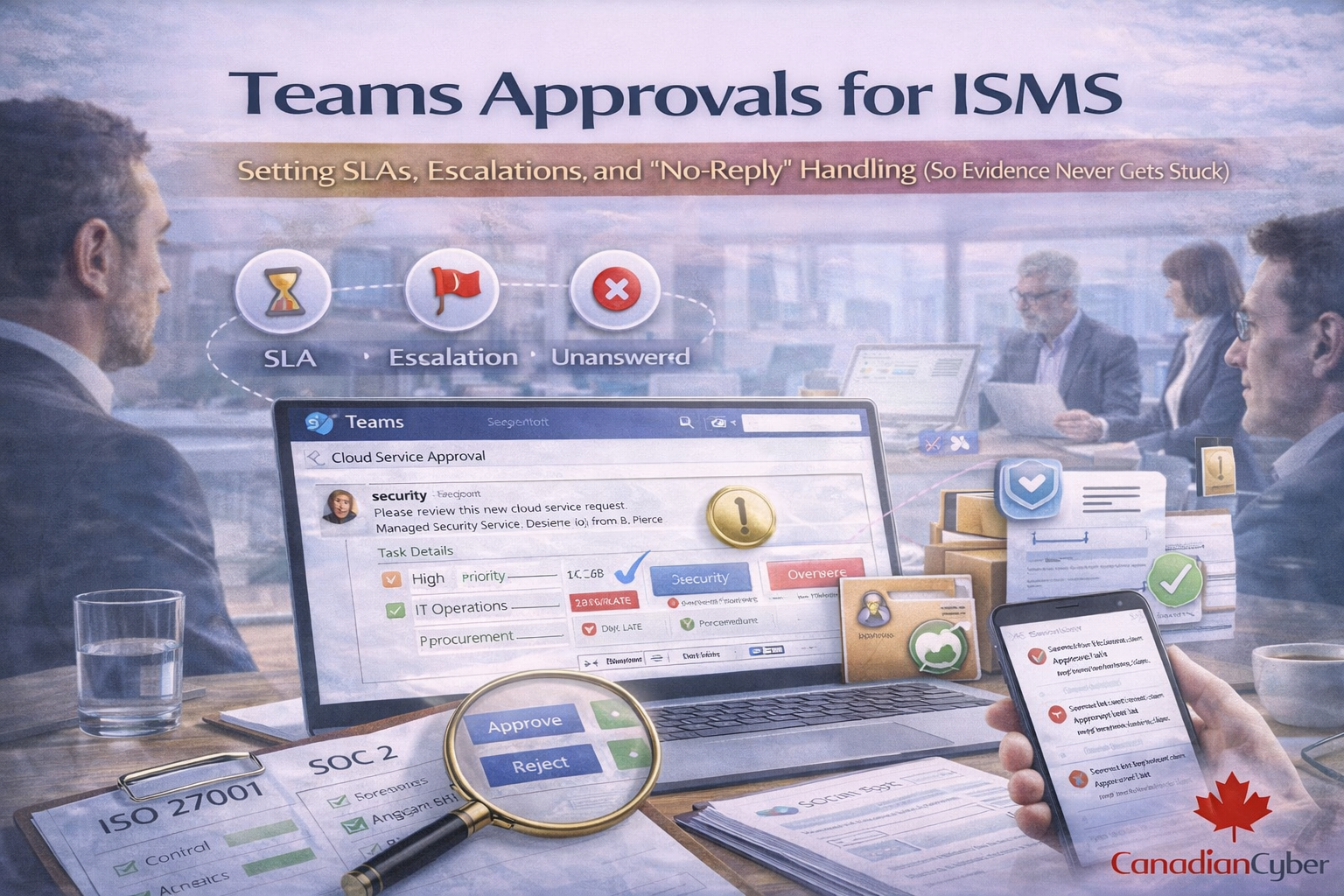

To support SOC 2 readiness, the vCISO implemented a SharePoint-based ISMS:

- Centralized policies

- Evidence tracking

- Approval workflows

- Audit-ready documentation

Bottom line:

Spreadsheets were retired.

Structure replaced chaos.

Step 4: coaching the team for audit confidence

The vCISO didn’t just prepare documents.

They prepared people.

- Ran mock auditor interviews

- Helped teams answer questions clearly

- Clarified evidence expectations

By the time auditors arrived, nothing felt unfamiliar.

Want SOC 2 readiness without the scramble?

Get a clear plan, control ownership, and audit-ready evidence guided by a vCISO who knows what auditors and banks expect.

The result: SOC 2 readiness that opened doors

Within months, the FinTech achieved:

- SOC 2 readiness with no major gaps

- Clean documentation and consistent evidence

- Confident audit participation

Most importantly:

Bank conversations restarted.

Security questionnaires moved faster.

Due diligence friction dropped.

What changed for leadership (before vs after)

Why this model works for FinTech

FinTech companies face bank-level scrutiny and limited internal bandwidth.

A vCISO provides the right leadership at the right time:

- Executive-level guidance without full-time overhead

- SOC 2 expertise with a practical roadmap

- Faster time to readiness and cleaner evidence

- Stronger trust in due diligence conversations

Canadian Cyber’s role in the engagement

Canadian Cyber supported this FinTech by:

- Acting as their virtual security leader

- Driving SOC 2 readiness end-to-end

- Implementing sustainable compliance structure

- Preparing the team—not just the paperwork

Final takeaway

SOC 2 isn’t just about passing an audit.

It’s about proving trust especially to banks and enterprise buyers.

With vCISO leadership, fast-moving FinTechs can move from chaos to control and unlock new growth.

Make SOC 2 a sales enabler (not a blocker)

Build credible readiness, faster due diligence responses, and audit-ready evidence without hiring a full-time CISO.

Stay Connected With Canadian Cyber

Follow us for real-world insights on SOC 2, vCISO leadership, and FinTech compliance in Canada: